Insurance and Takaful

/insurance-and-takaful/investment-linked-fund/

/insurance-and-takaful/investment-linked-fund/fund-information/

/insurance-and-takaful/investment-linked-fund/

/insurance-and-takaful/universal-life-fund/monthly-crediting-rate-2024/

/insurance-and-takaful/investment-linked-fund/

/insurance-and-takaful/tools-and-calculators/how-much-will-it-cost-for-my-child’s-tertiary-education/

/insurance-and-takaful/investment-linked-fund/

Fund Information

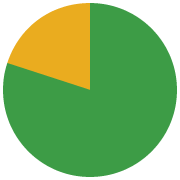

High Risk

Medium Risk

Low Risk

Cash/Money

Market

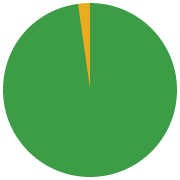

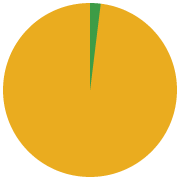

100% Shariah-compliant equities and equity related securities.

Fund objective

Achieve long term capital appreciation through investment in an international portfolio of Shariah-compliant equities and equity related securities.

Investor’s risk profile : HIGH

Equity

Maximum 100%

Cash/Money market

Balance of fund

Investment horizon

5-10 years

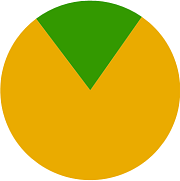

2%

Cash/Money Market

100% Shariah-compliant equities and equity related securities.

Fund objective

Achieve medium to long term capital appreciation through investments primarily in Asia Pacific ex Japan region.

Investor’s risk profile : HIGH

Equity

Maximum 98% Asia Pacific (ex Japan) equities

Cash/Money market

Balance of fund

Investment horizon

5-10 years

2%

Cash/Money Market

Minimum of 50% up to a maximum of 98% in collective investment schemes with exposures in US, Europe and Japan; and up to 50% in Malaysian securities

Fund objective

Maximise long-term capital growth through global equities exposure.

Investor’s risk profile : HIGH

Equity

Minimum of 50% up to a maximum of 98% in collective investment schemes with exposure in US, Europe and Japan; and up to 50% in Malaysian securities

Cash/Money market

Balance of fund

Investment horizon

5-10 years

2%

Cash/Money Market

98% Shariah-compliant investment in the emerging and developed markets of Asia Pacific ex Japan region.

Fund objective

Achieve long term capital appreciation and income through Shariah-compliant investment in the emerging and developed markets of Asia Pacific ex Japan region.

Investor’s risk profile : HIGH

Equity

Maximum 98%

Cash/Money market

Balance of fund

Investment horizon

5-10 years

2%

Cash/Money Market

98% Shariah-compliant investment in the emerging and developed markets of Asia Pacific ex Japan region.

Fund objective

Achieve long term capital appreciation and income through Shariah-compliant investment in the emerging and developed markets of Asia Pacific ex Japan region.

Investor’s risk profile : HIGH

Equity

Maximum 98%

Cash/Money market

Balance of fund

Investment horizon

5-10 years

2%

Cash/Money Market

98% Malaysian shares

Fund objective

Maximise capital growth over the medium to long term through the stock market.

Investor’s risk profile : HIGH

Equity

Maximum 98% listed Malaysian shares

Cash/Money market

Balance of fund

Investment horizon

5-10 years

2%

Cash/Money Market

98% Asian (ex Japan) equities and/or fixed income securities.

Fund objective

Provide stable income through dividend yielding stocks and fixed income securities.

Investor’s risk profile : HIGH

Equity

Maximum 98% Asian (ex Japan) equities and/or fixed income securities.

Cash/Money market

Minimum 2% of fund's NAV

Investment horizon

5-10 years

Maximum 5%

Cash/Money Market

Minimum 95% Equity Fund

Fund objective

To provide capital appreciation through investments in one collective investment scheme that invests primarily in a diversified portfolio of technology related companies.

Investor’s risk profile : HIGH

Equity

Minimum 95%

Cash/Money market

Maximum 5%

Investment horizon

5-10 years

Maximum 15%

Cash/Money Market

Minimum 85% Equity Fund

Fund objective

Achieve long-term capital growth through investment in a relatively concentrated, actively managed portfolio of global equity securities issued by companies with a high overall positive impact on society.

Investor’s risk profile : HIGH

Equity

Minimum 85%

Cash/Money market

Maximum 15%

Investment horizon

5-10 years

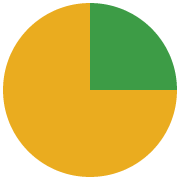

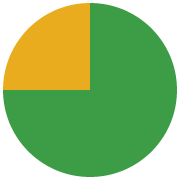

25%

Sun Life Malaysia

Conservative

75% Sun Life Malaysia Growth

Fund objective

Provide a mix of exposure into equities and bonds, with higher allocation in equities.

Investor’s risk profile : HIGH

Equity

75%

Fixed income

25%

Investment horizon

5-10 years

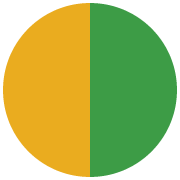

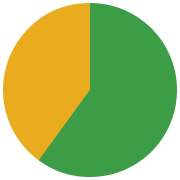

50%

Sun Life Malaysia

Conservative

50% Sun Life Malaysia Growth

Fund objective

Provide a balance of exposure into equities and bonds.

Investor’s risk profile : MEDIUM

Equity

50%

Fixed income

50%

Investment horizon

5-10 years

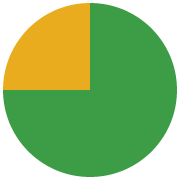

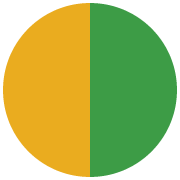

75%

Sun Life Malaysia

Conservative

25% Sun Life Malaysia Growth

Fund objective

Provide a mix of exposure into equities and bonds, with higher allocation in bonds.

Investor’s risk profile : LOW

Equity

25%

Fixed income

75%

Investment horizon

5-10 years

2%

Cash/Money market

98% Malaysian Bonds

Fund objective

Achieve medium to long term capital appreciation through investments primarily in Malaysian bonds.

Investor’s risk profile : LOW

Fixed income

Maximum 98% Malaysian bonds

Cash/Money market

Balance of fund

Investment horizon

5-10 years

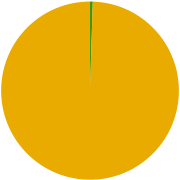

100%

Bonds

Fund objective

Provide a steady income stream over the medium to long-term period through investments primarily in bonds and other fixed income securities.

Investor’s risk profile : LOW

Fixed income

Minimum 70% up to a maximum of 100% bonds

Cash/Money market

Balance of fund

Investment horizon

5-10 years

High Risk

Medium Risk

Low Risk

Cash/Money

Market

100% Shariah-compliant equities and equity related securities.

Fund objective

Achieve long term capital appreciation through investment in an international portfolio of Shariah-compliant equities and equity related securities.

Investor’s risk profile : HIGH

Equity

Maximum 100%

Cash/Money market

Balance of fund

Investment horizon

5-10 years

2%

Cash/Money

Market

98% Shariah-compliant investment in the emerging and developed markets of Asia Pacific ex Japan region.

Fund objective

Achieve long term capital appreciation and income through Shariah-compliant investment in the emerging and developed markets of Asia Pacific ex Japan region.

Investor’s risk profile : HIGH

Equity

Maximum 98%

Cash/Money market

Balance of fund

Investment horizon

5-10 years

2%

Cash/Money

Market

98% Shariah-compliant equities.

Fund objective

To provide capital growth over medium to long-term mainly through various growth-oriented Shariah-compliant equities.

Investor’s risk profile : HIGH

Equity

Maximum 98%

Cash/Money market

Balance of fund

Investment horizon

5-10 years

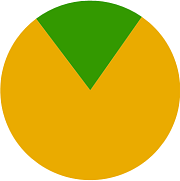

60%

Cash/Money

Market

40% Shariah-compliant equities.

Fund objective

Provide regular income stream through Shariah-compliant investments

Investor’s risk profile : MEDIUM

Equity

Maximum 40%

Cash/Money market

Balance of fund

Investment horizon

5-10 years

Fund objective

Provide income and capital appreciation over the medium to long-term by investing in Shariah-compliant equities and Sukuk globally.

Investor’s risk profile : Medium

Asset allocation

40% to 60% Shariah-compliant equities

40% to 60% Sukuk, Islamic money market instruments or placement of Islamic Deposit with financial institutions;

Up to 20% Unrated Sukuk

Investment horizon

5-10 years

Maximum 30%

Cash/Money

Market

Minimum 70% Shariah-compliant equities and Shariah-compliant equity-related securities

Fund objective

Achieve long-term capital growth.

Investor’s risk profile : MEDIUM

Equity

Minimum 70%

Cash/Money market

Maximum 30%

Investment horizon

5-10 years

Fund objective

Provide capital growth through investments in one Islamic collective investment scheme, which invests in a diversified portfolio of global assets.

Investor’s risk profile : MEDIUM

Asset Allocation

At least 85% in master fund; up to 15% in Islamic Liquid Assets.

Investment horizon

Medium to long term

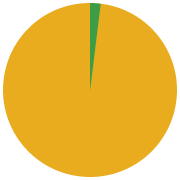

20%

Cash/Money Market

80% Fixed income securities

Fund objective

To provide returns mainly through Malaysian Shariah-compliant bonds and other Shariah-compliant fixed income securities.

Investor’s risk profile : LOW

Fixed income

Minimum 80%

Cash/Money market

Balance of fund

Investment horizon

5-10 years

Fund objective

Provide investors with liquidity and regular income, whilst maintaining capital stability by investing primarily in deposits that comply with the Shariah principles.

Investor’s risk profile : LOW

Asset Allocation

At least 95% in Islamic Deposits; up to 5% in Cash.

Investment horizon

Short term